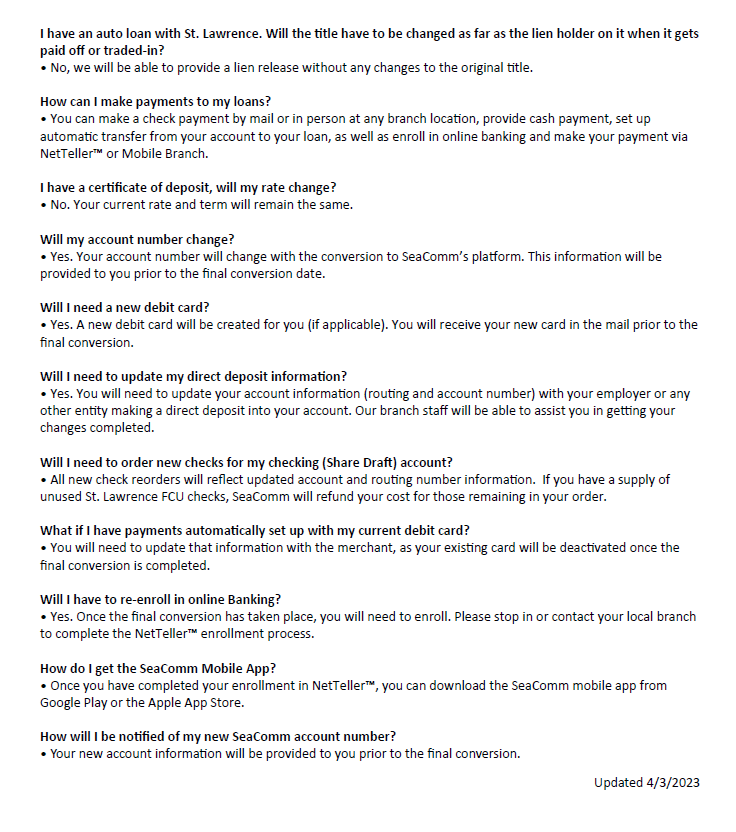

Merger Vote Results:

1,023 Yes

2,428 No

SeaComm CEO and St. Lawrence Federal Credit Union CEO, discuss the proposed merger

Every Vote Counts!

Embrace this opportunity to unite!

As one north country credit union, WE ARE STRONGER. Please do not forget to complete and mail your ballot. Exercise your right to vote!

I am bringing attention to the announcement this week of Americu’s field of membership expansion into St. Lawrence County. Americu, a large credit union, $2.7 Billion in assets, will now be a direct competitor to St. Lawrence Federal Credit Union, $233 Million in assets. Every business in this world is getting larger. There are fewer and fewer small farms, small retail, small hospitals, etc. The credit union and banking industries are not immune to this. There will be approximately as few as 3,000 credit unions by 2030. There have been nearly 500 credit union mergers in the last three years and nearly 100 so far in 2023. The population and jobs of St. Lawrence County are decreasing, as evidenced by the U.S. Census. The only way for Americu to gain membership is to attract our and other credit union members away and they have the size and capability to do this. If you want a local, north country originated and headquartered credit union, I encourage you to vote yes. If we don’t merge, it is a matter of time, and a short period of time at that, before there will not be any small credit unions.

If this merger is voted down, there will have to be changes to St. Lawrence FCU so we can try to survive in an environment that is completely different than what we all have been accustomed to in the north country. Current employees have a much better opportunity for financial and professional gain in a combined credit union. St. Lawrence FCU will be limited in its ability to grow. Increased membership is an absolute necessity to grow. With increased competition from larger credit unions, maintaining current membership will be very challenging. This will stifle employees’ opportunities and limit us in providing products and services to membership.

The challenges a small credit union faces in today’s environment are enormous. There is increased competition, non-traditional financial providers (Chime, Ally, Rocket Mortgage, Quicken Loans), and regulatory pressures that smaller credit unions will suffer from. The opposition to this merger from some are for reasons that we all deal with today. It is very common to have to change account numbers, direct deposits, and electronic debits due to fraud and other factors. Most of us have had to get a new debit card which is a change of numbers and adjustments of information for vendors you do business with. Changing account numbers used to be something we never had to do but today, due to fraud threats, changing account numbers and other card numbers is actually a mechanism to help prevent fraud. We are aware of concerns of changing these numbers and we are and will be prepared to guide and assist you through this process.

Message to St. Lawrence Federal Credit Union Members

We recently received regulatory approval from NCUA to have the vote of the membership

The following will be put in the mail on Wednesday, July 12, 2023:

Letter to Members (Notice of Meeting of the Members of St. Lawrence Federal Credit Union)

Ballot for Merger Proposal

Addressed, Postage Paid Envelope

The envelope you receive will have the words: ENCLOSED MERGER VOTE INFORMATION

The Letter to Members will have instructions on how to vote. You can vote one of two ways. Your ballot

can be mailed in the addressed, postage paid envelope to the third party who is managing the voting

process or bring your ballot to the Meeting on August 28, 2023, 5:30 PM at Best Western in Canton. You

can only submit your own ballot at the meeting. Each eligible member can only vote once. Once you

cast your ballot, you can’t change your vote.

DO NOT DROP OFF YOUR BALLOT TO ANY OF OUR BRANCHES OR PUT THEM IN OUR NIGHT DEPOSITS.

It became apparent at the end of our due diligence and discussions that choosing to merge into

SeaComm was the correct choice. The financial industry is changing rapidly. The industry estimates

there will be only 3,000 credit unions remaining by 2030. The majority of those will be over $1 billion in

assets. We are not in a position to grow to that level before 2030. There have been over 70 credit union

mergers, so far, in 2023. We decided to act now while we could dictate some terms rather than wait

until we could not. This merger allows the North Country to keep a headquartered institution in St.

Lawrence County that will be large enough to meet the challenges that are happening now and will

continue to happen. Change is not always popular but is necessary.

We encourage you to vote yes to merge.

Please contact the credit union with any questions you may have.

Letter from the joint Board of Directors

Building a Future Together

These past few months you may have felt overwhelmed with the amount of news and information you have received about the decision we have made to move forward with a merger of our two credit unions. None of which we took lightly. In fact, we have been discussing mergers for a number of years in our strategic planning sessions. Maybe not specifically the one we are proposing today, but certainly the thought that we need to be prepared for the future and build upon what we have today. And, that meant a merger partner.

It may not seem apparent and you may be asking, why would a fiscally healthy credit union merge into another fiscally healthy credit union? It may have been more palatable if one of us were financially distressed and needed saving. That would make sense. The fact is the most opportune time to plan a merger is when both are financially sound and can be stronger together without one weakening the other.

One of the major responsibilities we have as boards is to think and act strategically. What makes sense in the future... five, ten and even twenty years from today! That is exactly why we are doing it. We want to ensure we are able to serve you all well into the future. We can’t change what happens today, but we can position ourselves for the future with the right planning. And, of course we can make those decisions so they are not reactive, but proactive.

It is even clearer today, than it was back in November when we began merger discussions that this merger is well matched. The financial institution landscape has been changing and we want to ensure we are well positioned for it. We will be stronger together than apart. Combining resources allows both highly compatible, similar-cultured, like minded, St. Lawrence County credit unions the opportunity to serve you better!

We want to assure you that no employee from either organization will lose their jobs. In fact, all St. Lawrence staff will retain their years of service and current rate of pay. This will also create more career opportunities in the future. No branch will close and you will be served at the same locations you have come to love, by the same staff who have taken good care of you. In fact, signage on all St. Lawrence branches will remain for a minimum of five years.

It is important that we set the record straight and let you know that CEO Todd Mashaw is not receiving any additional compensation that he would have not been entitled to if he had worked until his retirement date. No member of the senior management team has been offered any incentive.

Our commitment to you all is that you continue to be served by the same people in the same locations as you have been accustomed. Our lending philosophy will not change. In fact, what will change is the additional service offerings, such as SeaComm’s Personal Financial Services and the loyalty rewards which will be available on day one.

We ask that you take the time to learn more about this merger and the long-term benefit it will have to everyone. Merger information is available on both our websites: stlawrfcu.com and seacomm.org.

Respectfully,

Press Release

March 2, 2023

Contacts:

Todd Mashaw, President/CEO, 315-393-3530, ext. 1110 or email: tmashaw@stlawrfcu.com

Scott A. Wilson, President/CEO, 315-764-0566, ext. 246 or email: swilson@seacomm.org

St. Lawrence FCU Has Agreed to Merge into SeaComm FCU

St. Lawrence County-based St. Lawrence Federal Credit Union’s Board of Directors recently voted to move forward with a merger into SeaComm Federal Credit Union, Massena, NY.

St. Lawrence Federal Credit Union has $226 million in assets, 12,289 members, 52 employees and six retail branch locations throughout St. Lawrence County, including two most recently opened in Heuvelton and Hermon. SeaComm, with $770 million in assets, 52,977 members and nine retail branch locations, serves St. Lawrence, Franklin, Essex, Clinton, Jefferson and Lewis Counties, in NY and Grand Isle, Franklin and Chittenden Counties in Vermont.

“We are excited to partner and merge into a St. Lawrence County originated credit union with a reputation of strong member and employee commitment. SeaComm Federal Credit union has a CEO with 15 years of leadership experience and very strong financials. This merger will help ensure there will always be a locally originated credit union that can better compete with the challenges that will be faced in the future” states Douglas Loffler, Chairman, St. Lawrence Federal Credit Union Board of Directors.

“We are pleased to be able to be part of such a well-run Credit Union like St. Lawrence,” states Myron Burns, Chairman, SeaComm Board of Directors. “We will ensure as this merger moves forward that St. Lawrence’s members, who will become members of SeaComm, are taken care of in the same high-touch, personal, friendly and attentive manner they have always been accustomed to,” he adds.

“This merger will unite two like-minded, member-focused, similarly cultured, highly compatible North Country Credit Unions into one, making it even stronger. Both Credit Unions know the value of being there for our members and our employees,” states Todd Mashaw, St. Lawrence President & Chief Executive Officer. “We both make lending decisions in our branches and work hard to make choices that will always have a positive impact on our members. Both do what is right for our members. That said, we are in a unique strategic position today to build upon two-long standing, well-run organizations that know our members and what the needs of our communities are all about,” he adds.

Through this merger, the members will have access to a larger branch network across the North Country from Watertown to Massena, Malone to Plattsburgh and South Burlington, and Essex, Vermont. In addition they will have access to increased service and product offerings, such as SeaComm’s personal financial advisor services, as well as their loyalty rewards to name just a few. “We are very excited to have St. Lawrence become a part of SeaComm. This is a transformational partnership that will enhance what we are able to do for all our members, employees and communities in which we operate. Both Credit Union’s mission and values are succinctly aligned and will only strengthen the Credit Union as we move forward together well into the future,” states Scott A. Wilson, SeaComm President & Chief Executive Officer. “A key to the success of this merger will be the staff who will remain in their branch / office locations to continue to take care of the members as they do so well, adds Wilson.”

No St. Lawrence Credit Union branches will close, or will any staff lose their jobs due to the merger. Everyone will remain in place and will continue working with the members to ensure their financial needs continue to be met. Todd Mashaw will retire as CEO and will be retained as a consultant for one year post merger.

Under the terms of the agreement, which was approved by the boards of directors of both credit unions, one (1) St. Lawrence Board Director will join the SeaComm Board. There will also be an advisory committee formed from the current St. Lawrence Board providing advice and counsel on the overall effect of the merger. The combined organization will operate under the SeaComm brand.

SeaComm’s 30 Stearns Street location in Massena, NY, will be the overall headquarters with St. Lawrence’s, 800 Commerce Park Drive in Ogdensburg as a major operations center. SeaComm has an additional operations center located on Smithfield Blvd in Plattsburgh, NY, to support its eastern Vermont operations.

Both Credit Unions have completed a rigorous due diligence process. The merger will require regulatory approval and a member vote which is expected to take place this summer.

Letter to Members

Dear Valued Member,

We are happy to announce that your Board of Directors has been in discussion with SeaComm Federal Credit Union for a number of months about a merger of our two Credit Unions. Both Credit Unions have completed a rigorous due diligence process. On February 21, 2023, your Board voted to approve a merger agreement bringing both organizations together.

Why merge? Both St. Lawrence Federal Credit Union and SeaComm Federal Credit Union are doing well. Even with that said, credit unions continue to face challenges in an increasingly competitive environment. A couple of these challenges are from non-traditional banking options such as financial technology firms (fintechs) and Wal-Mart offering checking accounts, along with other financial institutions that have moved into our territory and those that will move into our territory. As we look back, 15 years ago there were 8,300 credit unions, and today only a decade and a half later there are 4,853 across the US. This merger will help solidify our ability to serve you well into the future.

This merger will take two like-minded, member-focused, similarly cultured, highly compatible North Country Credit Unions, and combine them into one even stronger. Both Credit Unions know the value of being there for our members and our employees. We both make lending decisions in our branches and work hard to make decisions that will always have a positive impact on our members. Both organizations focus on doing what is right for our members. With that being said, we are ina unique strategic Position today in that we can build upon two long-standing, well-run organizations that, know our members and what the needs of our communities are all about.

Our missions of “People Helping People” and our guiding principles as member-focused Credit Unions are succinctly aligned. We knew that from the very first meeting with their CEO, Scott Wilson, and members of their Board of Directors. We are truly honored to be a partner with SeaComm. We will place particular attention on ensuring that you continue to be taken care of in every interaction with the merged Credit Union and everyone will work very hard to continue to exceed your service expectations.

No branches will close, and no staff will lose their jobs due to the merger. Everyone will remain in place and will be working with you so that your financial needs continue to be met in the same friendly manner you have been accustomed to. You will see the same faces and work with the same employees you are used to. Everything will remain the same as you have come to know and expect from the Branch experience. Additionally, you will have access to a larger branch network and additional service and product offerings, such as SeaComm’s personal financial advisor services and their loyalty rewards. Your time as a member will transfer giving you access to SeaComm’s robust loyalty rewards program.

A separate informational piece with detailed information about the merger and its process will be mailed directly to you in the near future. We will also have a separate page on our website outlining all key details. This will require regulatory approval and a membership vote. We will be holding “Town Hall” style meetings in all of our branches sometime in late March, whereby you can speak with me and CEO Scott Wilson about this merger. Dates, times, and locations of those meetings will be forthcoming. In the meantime, if you have any specific questions about anything related to the merger or in particular about SeaComm, please do not hesitate to call me directly at 315-393-3530 ext. 1110, or email tmashaw@stlawrfcu.com. Of course, you can always stop by our Main Office at 800 Commerce Park Drive, Ogdensburg, NY to see me.

We are joining a 52,977 members strong Credit Union. In addition to our own six branches, you will have access to their nine branches and all their ATMs across the North Country from Watertown to Massena, Malone to Plattsburgh, South Burlington and Essex, Vermont. I will retire as CEO. Although I am retiring, I will be available to the Credit Union as a consultant for one year following the merger. This merger is good for us as a Credit Union, and I look forward to talking with you as this process continues to move forward.

Sincerely,

Todd Mashaw

President & Chief Executive Officer

Media Print

St. Lawrence FCU & SeaComm FCU Merger Questions:

Come join St. Lawrence FCU’s CEO, Todd Mashaw & SeaComm's FCU’s CEO, Scott Wilson at the following Town Hall meetings.

They will be visiting all of St. Lawrence FCU branches to give you an opportunity to ask any questions you may have about the potential merger.

Locations, dates & times:

Thursday, March 16

Ogdensburg - State Street: 10am - 12pm

Ogdensburg - Commerce Park: 1pm - 3pm

Tuesday, March 21

Canton: 10am - 12pm

Potsdam: 1pm - 3pm

Thursday, March 23

Hermon: 9am - 10am

Heuvelton: 11am - 12pm

Monday, March 27

Ogdensburg - Commerce Park: 6pm - 8pm

Tuesday, March 28

Canton: 6pm - 8pm

Merger Timeline

Completed:

Preliminary Discussion

Due Diligence

Merger Agreement Approved & Signed by the Boards of Directors

Regulatory Approval - Merger Package Submitted to NCUA

In Progress:

Merger Vote Special Meeting of the Members of St. Lawrence FCU, August 28th at the Best Western University Inn, 90 East Main St, Canton, NY 13617 at 5:30 pm

Upcoming:

Merger Vote by St. Lawrence FCU Members

Credit Union Comparisons

ST. LAWRENCE FCU:

MEMBERS: 12,280+

MILLION IN ASSETS: $226+

RETAIL BRANCH LOCATIONS: 6

EMPLOYEES: 50+

SEACOMM FCU:

MEMBERS: 53,000+

MILLION IN ASSETS: $775+

RETAIL BRANCH LOCATIONS: 9

EMPLOYEES: 100+

Merger Updates

March 14, 2023

Todd Mashaw, CEO of St. Lawrence FCU and Scott Wilson, CEO of SeaComm FCU discussed the reasons for the merger of the two credit unions at an all St. Lawrence FCU staff meeting. This gave the staff the opportunity to hear from both CEO’s, as well as the ability to ask direct questions.